Escrow Basics: Understanding the Fundamentals of Escrow Services

Escrow services play a crucial role in facilitating secure transactions across various industries, providing a neutral third-party intermediary to ensure that both parties fulfill their obligations. Whether you’re buying a house, selling a business, or purchasing a high-value item online, understanding the fundamentals of escrow is essential. In this article, we’ll explore the basics of escrow services, how they work, and why they are vital in modern transactions.

What is Escrow?

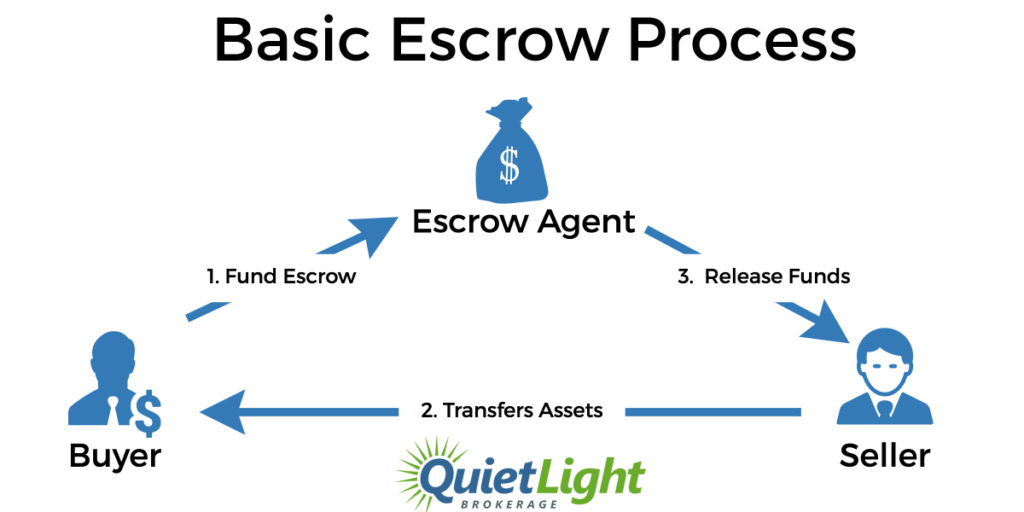

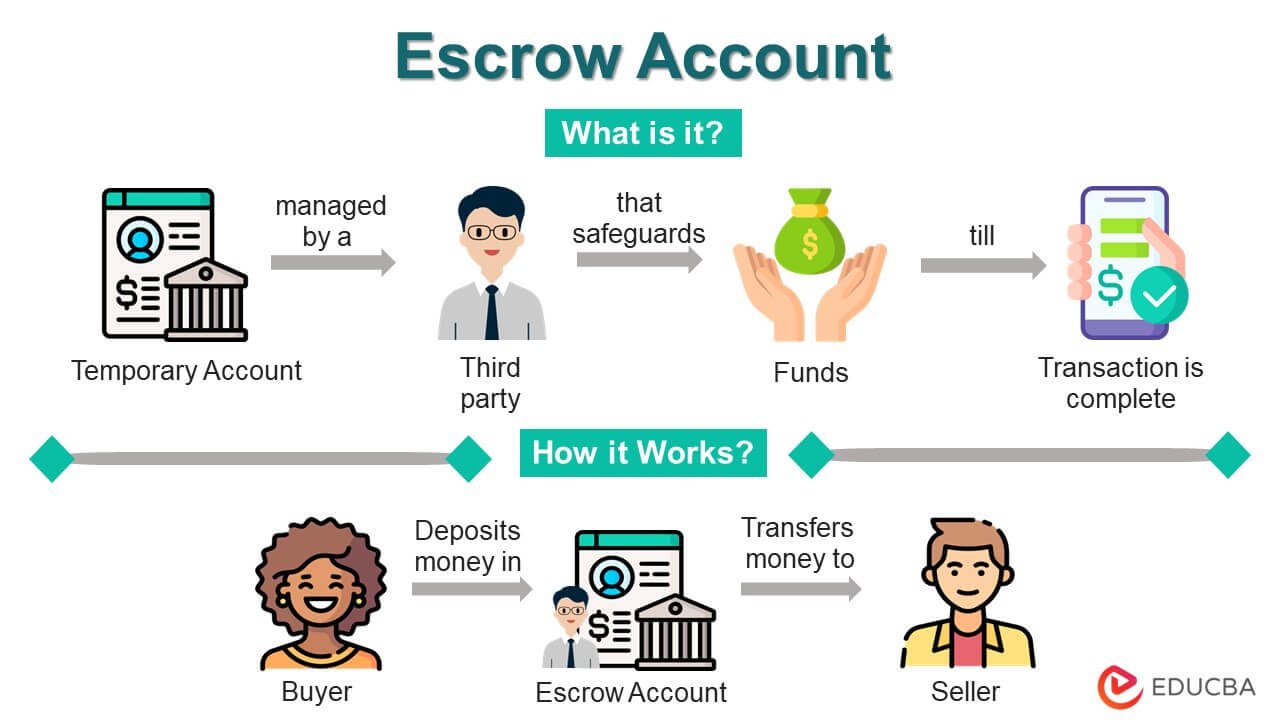

Escrow is a financial arrangement where a third party holds and regulates payment of funds or assets between two parties involved in a transaction. The escrow agent acts as a trusted intermediary, safeguarding the interests of both the buyer and the seller. Funds or assets are held in escrow until all the terms and conditions of the transaction are met, upon which they are released to the appropriate party.

How Does Escrow Work?

The escrow process typically involves the following steps:

- Agreement: The buyer and seller agree on the terms and conditions of the transaction, including the purchase price, delivery timeline, and any other relevant details.

- Opening Escrow: Once the agreement is reached, the parties open an escrow account with a trusted escrow agent. The buyer deposits the funds or assets into the escrow account.

- Verification: The escrow agent verifies the terms of the agreement and ensures that all conditions are met before releasing the funds or assets to the seller.

- Closing: Once the conditions are fulfilled, the escrow agent disburses the funds or assets according to the agreed-upon instructions. The transaction is then considered closed.

Why is Escrow Important?

Escrow services offer several benefits for both buyers and sellers:

- Security: Escrow provides a secure and transparent process, minimizing the risk of fraud or disputes. Funds or assets are held safely until all conditions are met, giving both parties peace of mind.

- Neutrality: The escrow agent acts as an impartial intermediary, ensuring that the transaction is conducted fairly and in accordance with the agreed-upon terms.

- Convenience: Escrow streamlines the transaction process, allowing for smoother and more efficient exchanges of funds or assets.

Conclusion

In conclusion, escrow services play a critical role in modern transactions, offering security, transparency, and peace of mind for all parties involved. Whether you’re buying a house, selling a business, or conducting an online transaction, understanding the fundamentals of escrow is essential for ensuring a smooth and successful outcome.

Stay tuned for our next article